Enabling entrepreneurs to innovate, operate and scale in an increasingly borderless digital world

Outsized Returns from Global Venture Investing in Fintech, Digital Transformation, Al & Web3

R3D3's mission is to help entrepreneurs innovate, operate and scale in an increasingly borderless digital world. We leverage our unique access to global technology, comprehensive market understanding and a strong ecosystem to help entrepreneurs maximize their full potential. Since 2018, the core team at R3D3 has been working and investing together, making successful investments in emerging markets, focusing on disruptive trends in financial technology, digital transformation including migration from Web2.0 to Web3.0; R3D3's unique blend of industry insights in technology, finance and Web3.0, as well as know-how in start-up and scale-up of new business models, distinguishes us from peers. This allows us to identify outstanding investment opportunities and achieve a sustainable success rate.

As the CVC arm of fintech conglomerate Rong360, we offer support in disruptive, cutting-edge technology, operations, and expansion for start-ups at the early, angel, and Series A and B funding stages.

We also have an active fund of fund strategy to exponentially grow our global venture investment ecosystem.

Our investment track record speaks for itself, with returns of 13x gross + realized over the past few years.

Exceptional

Track Record

Track Record

3X

realized MOIC

13X

total MOIC

3X

Successful exits

Seasoned

Founding Team

Founding Team

20+

years as founder / CXO

80+

years of operational experience

70+

deals executed

Full-Cycle

Resources Coverage

Resources Coverage

$80m

funding facilitated for portfolios

150%

average revenue CAGR since investment

100%

portfolios receiving synergistic support

Unique Synergies

from Rong360

from Rong360

150m

users serviced

2000+

FinTech Partnerships

500+

engineering, product & domain experts

Active strategy to exponentially grow our global investment ecosystem

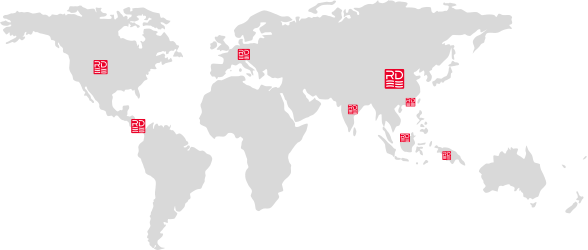

By Region

- We are actively deploying in Americas and Asia, with a small allocation to Europe and MENA

By Strategy

- Web3 funds

- AI / Fintech-focused funds

- Market focused funds (Latam, MEA)

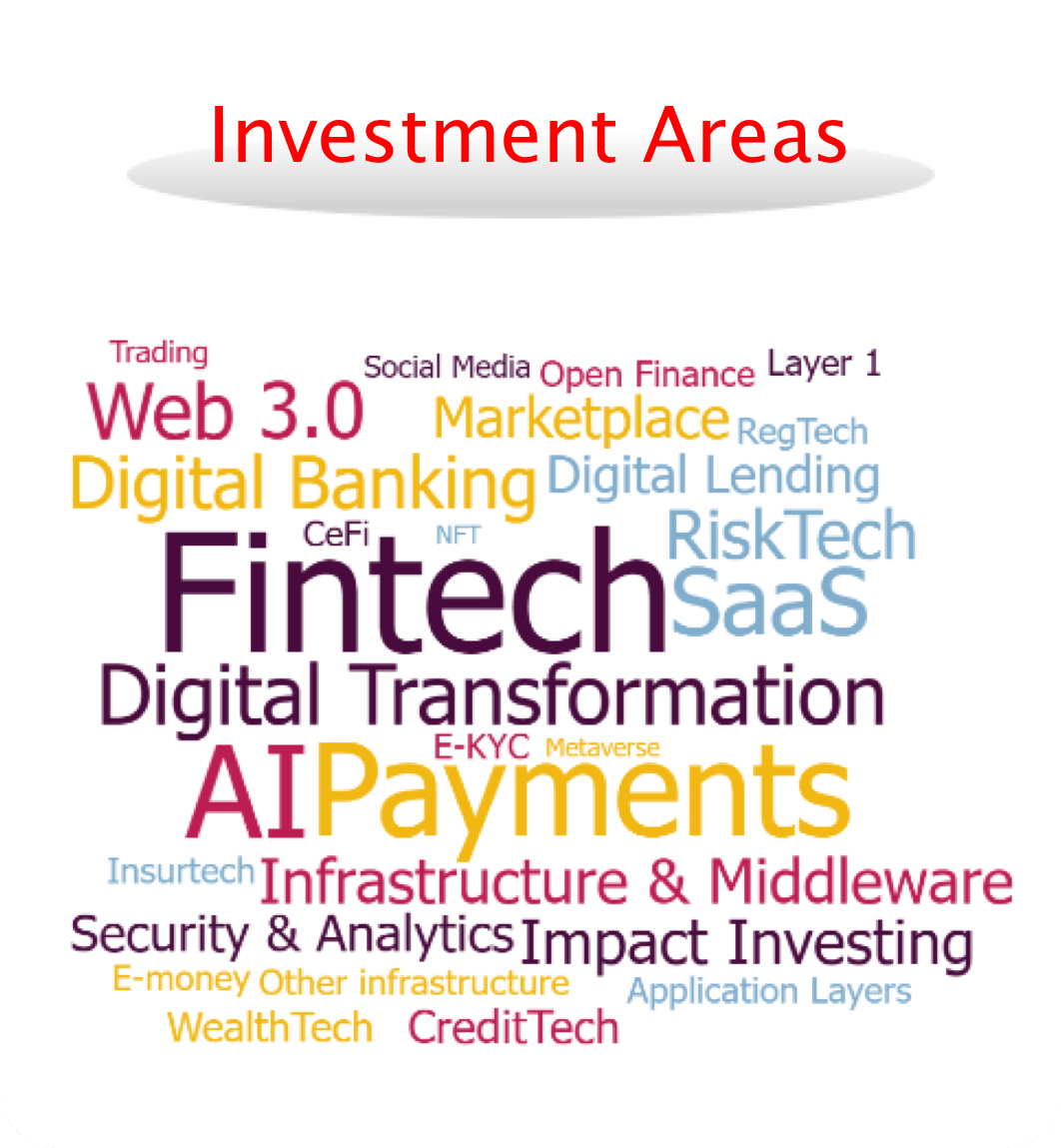

- Al (Infrastrature, Application Layer)Fintech & Web3

- Digital Transformation & Enterprise

Meet our portfolio

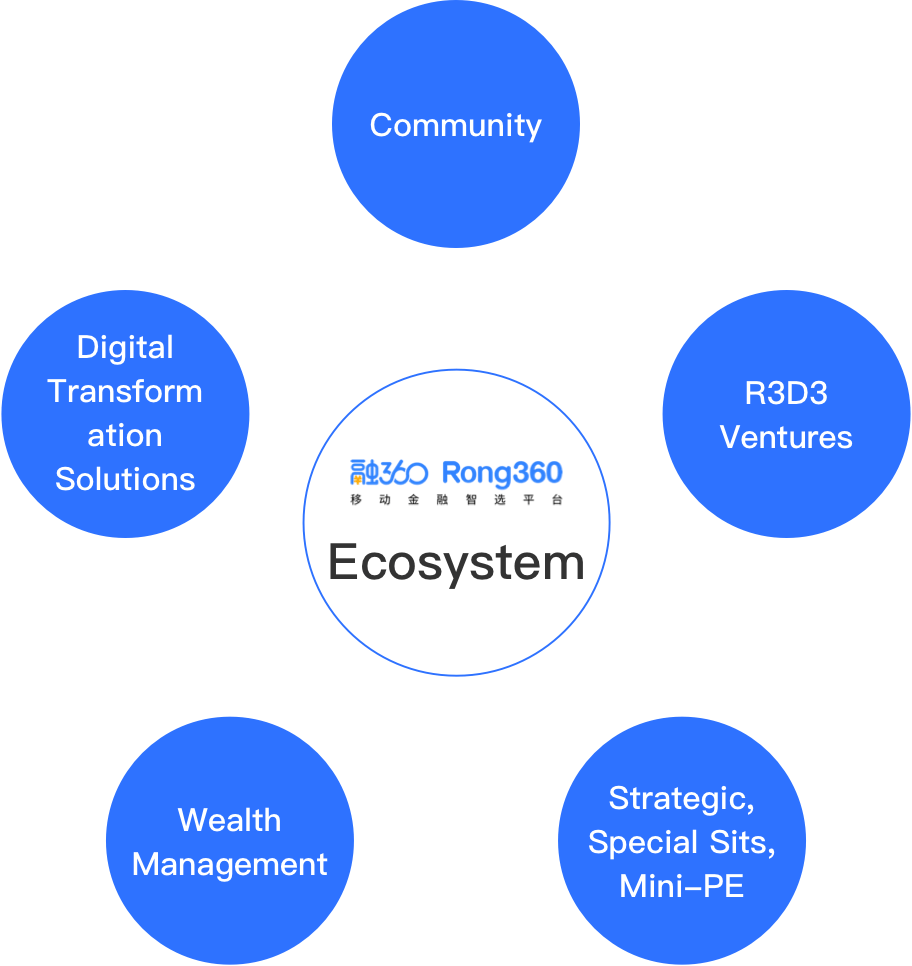

R3D3's unique value proposition stems from our corporate sponsor and ecosystem partners

Battle-tested

founding team

founding team

- Veterans from technology, finance, fintech and capital markets.

- 6+ years of working together in venture building, scaling and investing across multiple markets

Full cycle

resources for

portfolios

resources for

portfolios

- Deep connections to our network of entrepreneurs, industry leaders, top-tier investors, media partners and academic institutions.

Holistic investment

strategy

targeting value

creation

strategy

targeting value

creation

- Focusing on the intersecting crux of fintech, Web3.0 and AI movements

- Strong value-add via connecting and integrating strategic resources

- Targeting early stage opportunities with incubation, synergies and mentorship

Unique synergies

from Rong360

from Rong360

- Rong360's global ecosystem enables four pillars of synergies: People, Technology, Regulatory and Growth

R3D3 capitalizes on synergies with fintech leader RONG360

PEOPLE

Access to RONG360's global talent pool of engineering, product and domain experts, as well as our extensive experience assembling international teams across multiple emerging markets

REGULATORY

Accumulation of technical excellence and deep understanding of data in servicing 150+ million users and thousands of financial service providers

STRATEGY & GROWTH

20 regulatory licenses achieved across 5 markets and 7 categories, establishing strong relationships with key regulators and industry associations

STRATEGY & GROWTH

Access to top mentorship and incubation from our leadership (track record of bringing companies from inception to IPO) & global network of investors, advisors and growth opportunities

Multi-strategy Ecosystem Enabling Unparalleled Synergies

Top Tier Investors and Founders

- Foster deep relationships with like-minded investors (incubators/accelerators/VCPEs, conglomerates, LPs) and entrepreneurs for collaborative opportunities

Industry Partners, Regulators, Academia and Industry Alliances

- Strengthen global support network of advisory leaders that enable our ecosystem (banking, legal, audit/tax, security, compliance etc.)

- Promote our thought leadership and stay ahead of regulatory trends

Exporting Rong360 Expertise and Know-how to New Sectors & Markets

- Cross-over opportunities that require deep Web2 & Fintech know-how

- International partnerships in new markets

Early-stage Venture Success

- Fintech, Web3 & AI

- Angel, Pre-Seed, Seed, Series A

- Immigrant founders in international markets

Strategic Fund of Funds

- Highly selective for co-investment access to alternative sectors and geographies

- Small tickets with high synergies

Expanding Suite of Wealth Management Solutions

- Increase inbound lead-gen and channel partners

- Enhance product offering

- Strategic planning on licensing and compliance

Synergistic Dealmaking

- Strong alignment with existing businesses and/or core competencies and/or strategic direction

- Turnaround, fire-sale, private debt, special situations

- Open to consortiums, SPVs